The KRS token is a security-like product, issued by the ECIB European Credit Investment Bank and backed by the Regulatory Authority. The issuer of the STO has ownership of assets or equity or debt securities. Issuers need to apply high-quality, certified securities/assets for collateral or pledge under legal supervision, in order to legally and publicly issue securities-type tokens.

Located in the Pahang state mining area of Malaysia, this mountain range is rich in gold and a small amount of precious metals, it is Malaysia's famous gold chain mountain range. The first phase of exploration and development of the gold mine covers 250 acres. Preliminary surveys show very positive reserves, easily touching $100 million worth of gold reserves.

The total issuance of KRS token is based on the principle of collateral on the value of high-quality assets, and is strictly accounted for to ensure that the value of each KRS token is guaranteed.

250 acres x 43,560 square feet per acre = 10,890,000 square feet

A 10-times of the leverage ratio results in a total of 108,900,000, therefore

Total issuance of KRS token = 108,900,000 pieces

This means that the total collateralized assets per 10 KRS tokens are equivalent to 1 square foot of gold reserves. This value will even further multiplies with the increase in later mining areas.

KRS Allocation

5% Trustees Service & Sponsored Bank

Provide all financial and trust-related services.

5% Future Mining Development

The operation and development of gold reserves and future mining and development in planning

10% Marvel Capital

Provide project market operations, development and strategic strategy of the executive

10% Institutional Investor

Private equity and angel investors, legal entities for the project

20% Marketing Team

Responsible for marketing, fund raising and community building

50% Marketplaces

Retail investors who invest small amounts of money in projects

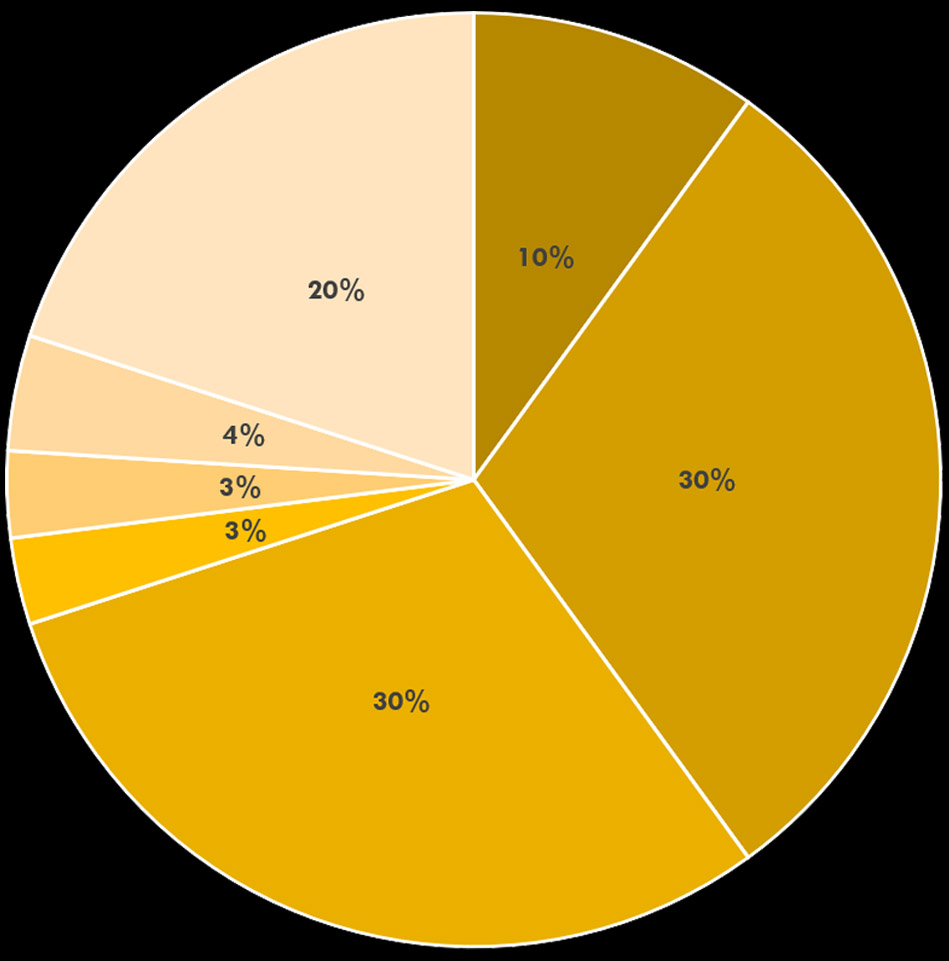

Gold Production Application

20%

Mining Expenses

30%

Green soil restoration (Agricultural replanting)

4%

Geological research funding

30%

Development of gold futures

3%

AI technology metal detection

10%

Repurchase KRS tokens

3%

Mine Development Compensation Fund

STO Advantages

About Gold Futures Hedging

Professional Trading Team

Operated by professional traders in the bank 25 years of trading experience

Professional Gold Trading Platform

European Credit Investment Bank

Hedging Trade Strategies

- • Open and close positions on the same day

- • Short and long orders

- • Flexible trading time and method

Gold Markets

Gold futures trading meets the requirements of national standard GB/T4134-2003.

The global gold market is a relatively mature, transparent and effective market with a relatively independent price system.

Gold futures with low risk of operation and price manipulation.

The gold market is currently on the rise, and the investment prospects are promising.

Gold is a financial asset that does not represent the ownership of any issuing organization.

NQ Mineral High Yield Bond “Grade A”

NQ Minerals Plc was established to acquire and develop mining assets to deliver significant shareholder value.

Focussed on- Low risk, low capital intensity opportunities

- Near term cash flows

- Politically and fiscally stable jurisdictions

A portfolio of attractive assets

With the acquisition of hellyer NQ Minerals has a portfolio of exciting opportunities across the mining lifecycle.

- Gold Prospect

- Advanced Drill Targets

- Large Breccis

- Saleable stockpiles

- Walk-up Drill Targets

- Multiple Metals

- Short Term

- Robust Cash Generation

- JORC Compliant

Hellyer Gold Mine - Near Term Project

The Hellyer project comprises a 9.5mt JORC compliant resource and an existing 1.2mtpa processing plant with related infrastructure. Based on recent historic prices, the gross value of in situ metals for this Resource in approximatelty US$2.7bn.

Robust margin

- High grade tailings

- High all-in margin due to available metal content combined with low mining and processing costs

Low capital intensity

- Existing base metal processing facilities on site

- Existing infrastructure for planned operations-water, power, railway spur line and nearby port.

Market savvy

- 3-stage sequential floatation to maximise concentrate saleability

- Optimisation of plant & product-tailored marketing approach

Low risk

- Economically viable asset with a clear plan for commercialisation

- low cost implementation and near term production leading to early cash flow and break-even

NQ Minerals' evaluation of Hellyer indicates the opportunity to fully process and commercialise the 11.24 mt in-situ tailings comprising a 9.5 mt JORC compliant resource of

- Gold at 2.61 g/t (795,000 oz)

- Silver at 104 g/t (32 Million oz)

- Lead at 3.03% (289,000 tonnes)

- Zinc at 2.50% (238,000 tonnes)